How My Ambition Properties are getting ahead of the EPC changes

EPC explained and the steps we are taking to beat the change

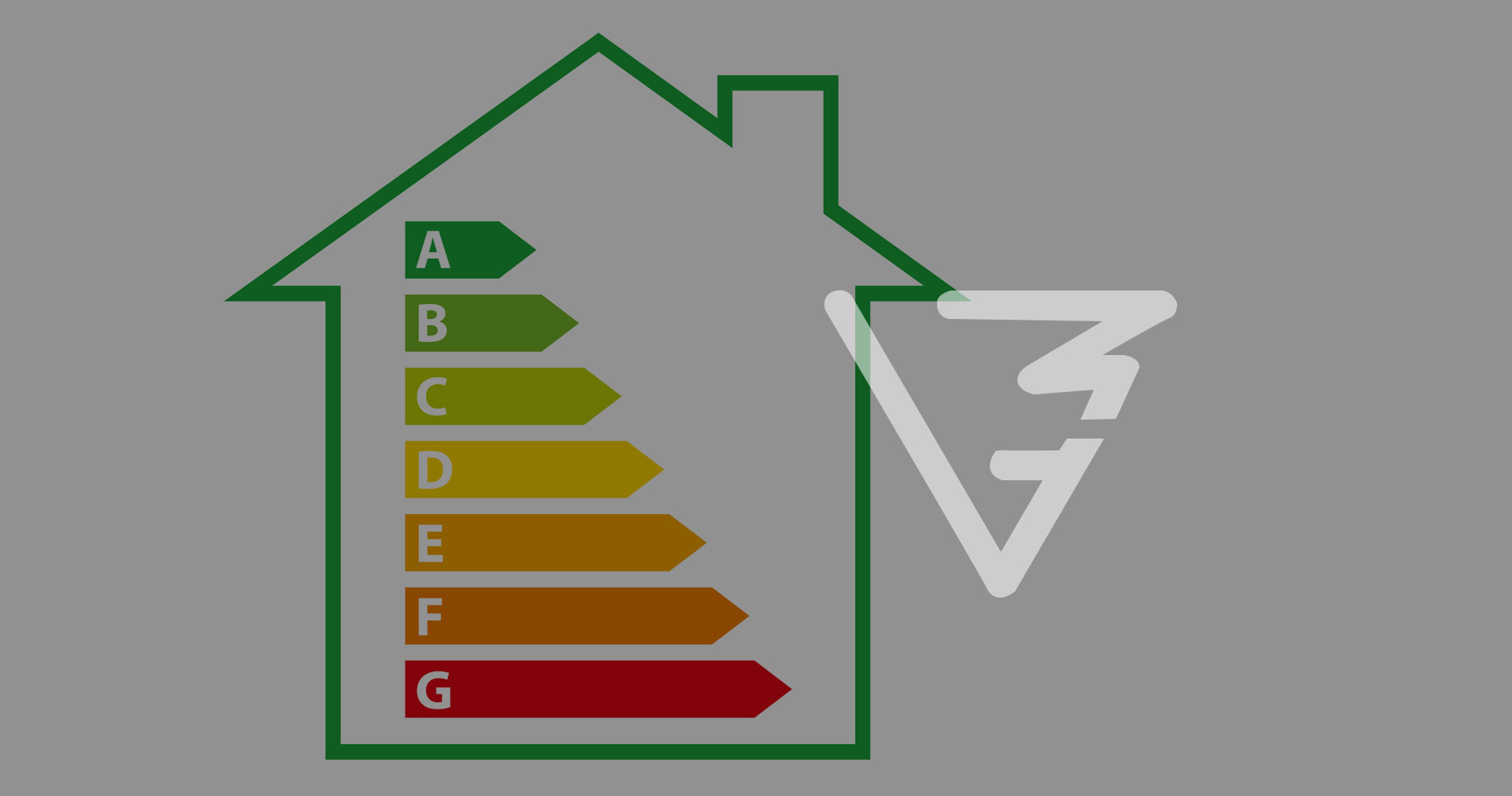

As landlords, we must reach a certain EPC score on our properties to rent them. But have you heard the news? The UK government plans to introduce significant changes to the Energy Performance Certificate (EPC) regulations soon.

The new rules are part of the UK's efforts to reduce carbon emissions and improve the energy efficiency of buildings. These changes will have a significant impact on landlords with rental properties. It's essential to be aware of what's coming and how it will affect both landlords and tenants.

What is an EPC?

The EPC is a legal requirement for all properties that are being sold or rented in the UK. Landlords are responsible for ensuring that their rental properties have a valid EPC, and they must provide a copy of the certificate to their tenants.

What are the proposed changes?

1. Minimum EPC rating of C for rental properties: Currently, a minimum EPC rating of E is required for rental properties. However, the government plans to introduce a minimum EPC rating of C for all rental properties starting in 2028. This means landlords will no longer be able to rent out properties with a lower EPC rating.

- Minimum EPC rating of C for rental properties: Currently, a minimum EPC rating of E is required for rental properties. However, the government plans to introduce a minimum EPC rating of C for all rental properties starting in 2028. This means landlords will no longer be able to rent out properties with a lower EPC rating.

- Improving EPC accuracy: The government is also planning to improve the accuracy of EPCs by introducing new data sources and methodologies. This will mean that EPCs will provide more accurate information about a property’s energy efficiency, which will help landlords and tenants make more informed decisions about energy use and cost.

How will this affect landlords with rental properties?

- Financial implications: Landlords will need to make improvements to their properties to meet the minimum EPC rating of C. This could involve making significant investments in energy-efficient measures such as insulation, double glazing, and more efficient heating systems. Landlords may also face higher costs in obtaining more accurate EPCs.

- Rental market changes: Landlords will no longer be able to rent out properties with an EPC rating below C. This means that some properties may become unrentable, and landlords may need to make significant investments to improve their property’s energy efficiency. This could lead to changes in the rental market, with more demand for energy-efficient properties. Alternatively, some landlords may be forced to sell the property, which could create a possible shortage in overall rentable properties.

- Compliance: Landlords will need to ensure that their rental properties meet the new EPC regulations. Failure to comply could result in fines and other penalties.

- Tenant demand: Tenants are increasingly looking for energy-efficient properties, and the new EPC regulations are likely to increase demand for such properties. Landlords who invest in energy-efficient measures may be able to attract higher-quality tenants and command higher rents.

How Is An EPC Measured?

The assessment takes into account various factors such as the property’s insulation, heating system, lighting, and ventilation, as well as the construction of the building itself. The assessor will also consider any renewable energy sources installed in the property, such as solar panels.

After completing the assessment, the assessor will produce a report detailing the energy performance of the property and assign it an energy efficiency rating. The report will also provide recommendations for improving the property’s energy efficiency, such as installing loft insulation or upgrading the heating system.

This score is made up of different elements within the property. Each component is awarded points, like double glazing, loft insulation, and wall insulation. These points are added up to correspond to the level.

To reach an EPC of “C”, a property must have between 69 and 80 points on the Standard Assessment Procedure (SAP). So landlords could find themselves weighing up the costs and benefits of each property improvement to decide whether to upgrade roof insulation or install double-glazing windows and bump their points above 69.

How My Ambition Properties Are Working With The EPC Change

We are working alongside an EPC assessor to ensure the correct level and/or actions are being taken in all our property upgrades. One of the many ways we are improving energy efficiency in our buildings is by upgrading to modern combi boilers across our properties.

Government Schemes To Help Landlords

- The Green Homes Grant: This is a government scheme that provides vouchers for homeowners and landlords to install energy-efficient improvements in their homes, such as insulation, double glazing, and heating upgrades. The scheme closed to new applications on 31 March 2022.

- The Energy Company Obligation (ECO): This is a scheme funded by the UK’s largest energy suppliers that provides funding for energy-efficient improvements to homes and rental properties. ECO can cover the total cost of measures like insulation, heating upgrades, and window replacements.

- The Landlord’s Energy Saving Allowance (LESA): This is a tax allowance that landlords can claim for certain energy-efficient improvements made to their rental properties. The allowance is worth up to £1,500 per property per year and covers measures like loft insulation, cavity wall insulation, and draught-proofing.

- The Private Rented Sector (PRS) Exemptions Register: Landlords of properties that do not meet the minimum EPC rating requirements can register for an exemption if they can demonstrate that they have taken all cost-effective measures to improve the property’s energy efficiency. However, PRS may well change once new EPC rules are introduced.

Wrapping Up

Disclaimer: The information contained in this article is designed for information purposes and subject to change dependant on government announcements. Requirements may vary from one country to another and over a period of time. Advice regarding relevant changes should be sought by a registered professional. My Ambition Properties Limited accepts no liability for any loss or damage as a result of the information contained within this article.